April rebound enables public pensions to recover half of Q1 losses; funded ratio climbs back to 69.8% on the strength of 5.92% market return

Funded status improves by $200 billion in April 2020

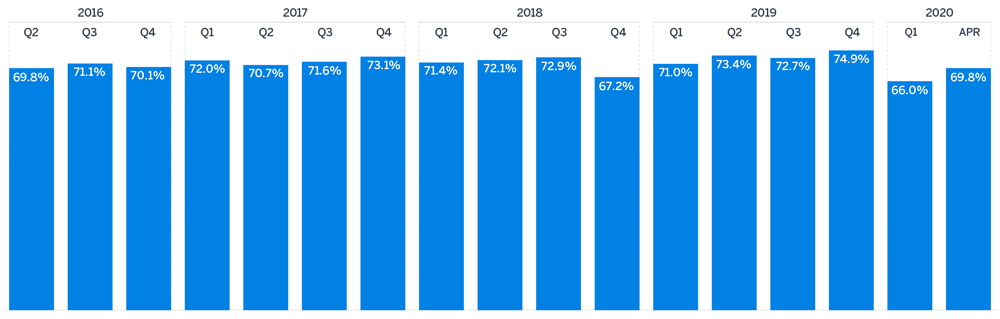

There were few safe investments during the first quarter of 2020, as economies shut down around the globe in response to COVID-19. But many sectors of the market showed positive signs of recovery in April, restoring some of the losses suffered in February and March. The estimated funded status of the 100 largest U.S. public pension plans as measured by the Milliman 100 Public Pension Funding Index (PPFI) now stands at 69.8%, a far cry from the heady 74.9% at the end of December 2019, but a significant improvement from 66.0% at the end of March 2020.

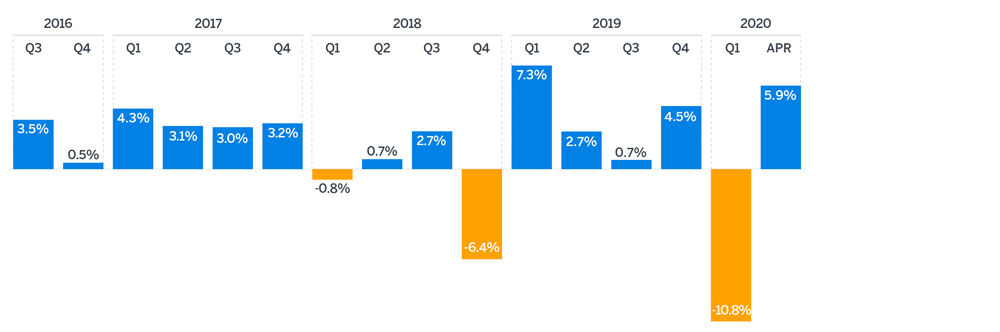

In aggregate, the PPFI plans experienced investment returns of 5.92% in April, welcome news after Q1’s dismal return of -10.81%. The Milliman 100 PPFI asset value recovered from $3.536 trillion at the end of March to $3.750 trillion at the end of April.

We estimate that the aggregate deficit shrank from $1.819 trillion at the end of March 2020 to $1.619 trillion at the end of April, a $200 billion improvement.

Figure 1: Funded ratio

Figure 2: Investment returns

This quarterly update reflects adjustments made as of the end of June 2019 as part of Milliman’s annual Public Pension Funding Study, found here at milliman.com/ppfs. The adjustments reflect updated publicly available asset and liability information gathered for the annual study.

Explore more tags from this article

About the Author(s)

Contact us

We’re here to help you break through complex challenges and achieve next-level success.

Contact us

We’re here to help you break through complex challenges and achieve next-level success.

Public Pension Funding Index, April 2020

The estimated funded status of the 100 largest U.S. public pension plans as measured by the Milliman 100 Public Pension Funding Index now stands at 69.8%, a far cry from the heady 74.9% at the end of December 2019, but a significant improvement from 66.0% at the end of March.