The political risk insurance market is expanding and has experienced year-on-year growth nearly every year since 2003. According to an April 2017 article from Carrier Management, one major insurance carrier said new business at its political risk and trade unit was up 14% in 2016. For the first quarter of 2017, the carrier has seen an 11% increase. Anecdotal evidence suggests that these levels of growth are broadly representative of the market as a whole, and that market premiums will continue to develop beyond their current level, roughly $2 billion per annum.

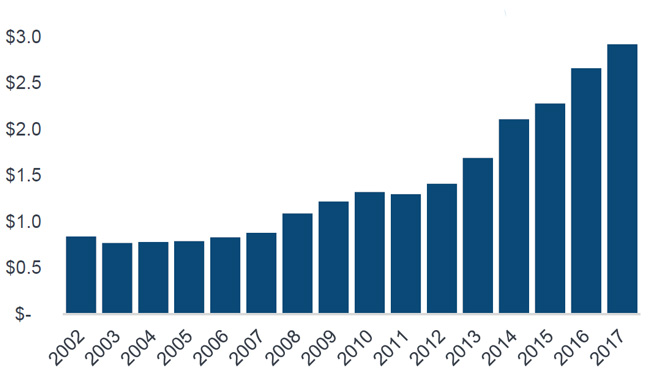

Capacity in the market has also increased considerably over recent years, with a theoretical single risk capacity of nearly $3 billion available at the start of 2017.

Figure 1: Market Capacity (single risk US$ billions)

What is driving the demand?

Increasing globalisation, political/economic instability, increased nationalism and protectionism, and the rise of political populism are some of the reasons. At the same time, insurers seem increasingly keen to assume some – usually not large amounts but some – political risk within their portfolios, ensuring that (so far) supply more than matches the increasing demand.

Political risk insurance is becoming increasingly important yet is not widely understood. This article explores the basics of political risk insurance and discusses why there is now greater demand for it.

Background

Political risk insurance is commercial insurance aimed to protect businesses and business ventures in locations and against perils that other conventional insurance policies would not cover. There is no standard political risk product. Instead, these policies tend to comprise cover against a variable bundle of perils that can include:

| Cover | Description | Example |

| Expropriation of property | Covers against a host country seizing a company’s development rights or facilities and its products for the host country’s own use | Nationalisation, confiscation and creeping expropriations which result in a loss of the total investment. (e.g., Bolivia issued a Supreme Decree which required producers to relinquish control of the production of hydrocarbons to the state oil and gas company) |

| Forced abandonment or forced divestiture | Covers against the forced abandonment of assets due to political violence | The abandonment of a company’s operations in a foreign country as a result of government advice to evacuate key personnel (e.g., Yemen) |

| Inconvertibility of currency | Covers financial loss incurred by the insured when it cannot convert local currency or repatriate funds out of a territory. Note, the risk of currency fluctuations is excluded from the cover | Discriminatory host government actions resulting in an inability to convert and transfer local earnings (e.g., restrictions on exchange of Venezuelan bolivars to U.S. dollars) |

| Consequential financial loss | Cover miscellaneous financial losses incurred by the insured as a result of political actions affecting their interests | Discrimination, embargos, licence cancellation or sanctions (e.g., sanctions impacting the ability to sell Russian assets) |

| Political violence | Covers against the physical damage to property as a result of political risks and any consequential financial loss | Politically motivated violence that results in property damage (e.g., Ukraine) and the associated business interruption |

| Non-repossession of an asset | Covers the interest of a lender that has provided lease finance on an asset in the event that the lessee defaults under the loan and the asset cannot be repossessed, deregistered and resold in order to repay the outstanding debt | Common in aircraft financing. Default can result in the aircraft being unable to be repossessed, deregistered and resold in the currency of outstanding debt |

| Trading risks | Covers the financial losses incurred by the insured that relate to trade risks | Import/export embargos and non-delivery of pre-paid goods |

Cover can be long term or short term, depending on the event being covered. For example, cover for trade risk might last for only 30 days, but cover for a major infrastructure development might be in place for several years. In fact, contracts that are five to seven years long are normal, though very few insurers will provide cover for longer than a 10-year period. The policies, however, may not last the full term. Coverage is often one-off, especially if it is project-based.

This translates to plenty of new business in the market with a relatively high acquisition cost, but very little renewal business.

Political risk insurance is not new, but it is not yet a fully mature market. The private market started in the 1970s, and business is written primarily through the major financial centres (i.e., London, New York, Singapore and Paris). There are state players, too, such as the Overseas Private Investment Corporation (OPIC) in the United States. This government agency has been helping American business invest in emerging markets since 1971.

Increasing globalisation and the increasing willingness of commercial enterprises to operate outside their national boundaries are driving demand for political risk cover. So, too, are the rise of nationalism and political populism in addition to continuing political instability in various parts of the world. All of these factors are increasing the awareness of commercial enterprises regarding the risks they are running when operating abroad and thus increasing their appetite for cover.

Management

The frequency of political risk claims is usually low, but the severity can be extreme. For example, expropriation is usually a total loss. On the other hand, for expropriation, there is material salvage potential, possibly to the extent that the loss is more than fully recovered. But that salvage potential may take years to be realised. For example, in Vietnam, two US banks made claims on their political risk cover for having to abandon property following the fall of Saigon in 1975. Those claims were duly paid by the insurer—which then bided its time until the normalisation of relations between the US and Vietnam in 1995 to take possession of the property and to realise salvage value.

Low claim frequency means that most insurers make a profit on this business in most years. But when they have losses, those losses can be material. This means that writers of political risk insurance should be adequately capitalised to assume the risk and avoid the temptation of profit taking during periods of low loss frequency.

Peril definitions are standard, and brokers might have their own standard policy wordings. But each contract is negotiated on an individual basis with the lead underwriter. Policy wordings are thus bespoke for each insured risk. And wording is key to ensuring that the insured has clear legal rights to whatever is imperiled by the political activity and that the political activity is the cause of the loss. Wording is also relevant to avoid issues of contract overlap or ambiguity regarding which of two possible covers applies. Bespoke policy wording should ensure that the political risk cover sits neatly alongside any other (e.g., standalone terrorism cover), thereby ensuring there is no gap or overlap in coverage supplied.

Onerous wording regarding claim notification gives considerable certainty to the claims management process, although the need to wait for restructuring to occur can confuse matters.

As many political risk covers are one-offs and as there is little by way of renewal business in this market, experience rating is not possible. However, underwriters will use as much information as is available, married to their own experience, to develop a bespoke premium for each cover. While region and other factors are relevant, considerable attention is paid to the identity of the insured, of the obligor and of the key personnel within the insured in relation to the trade deal or project. Underwriters need to consider the political and economic health of the region. When underwriting a political risk, looking only at the country in which that risk is placed is shortsighted. Countries on which that country is dependent or with which it has close links is also important as there is contagion risk. For example, underwriters providing cover to deals in Brazil keep an eye on China and Brazil because of China’s importance as a trading partner to Brazil. In the case of Brexit, it remains to be seen how dependent the UK is upon the EU for its trade.

Underwriters might use third party consultants to help them understand the linkages and level of risk. They will also use margins in the credit default swap market and information on what banks are charging for dealing in the country as additional material in assessing appropriate premium rates. Underwriters often have credit risk analysts on their teams, and a disproportionate number of underwriters appear to have a military background, particularly in military intelligence.

Because there is a shortage of reliable relevant statistics, actuaries are not heavily involved in developing premium rates for individual political risk covers. But they can be useful in introducing process, such as through simple pricing models that reduce the risk of mis-pricing and ensure the collection of relevant information for policy management, portfolio management and reserving purposes.

Pricing models for political risk are usually less about calculating appropriate premium rates and more about capturing the information, underwriter thought process and data, and about having a benchmark tool so risks can be compared relative to one another (and year on year). Pricing considerations include:

- Sum insured and term

- Country/region

- Industry/sector (and reliance on other sectors)

- Credit rating (this often does not exist, however)

- Proportion retained by client

- Experience of insured and obligor

- Structure and security of finance

- Physical security at site

This type of insurance can be a risky business. The underlying drivers of claims or linkages within the system (e.g., the impact of social media on aggregations) are not fully understood and so political risk insurance can be hard to underwrite or manage. This is reflected in the keen interest taken by regulators in those underwriting such covers. Insurers’ boards and their risk managers are just as nervous. Cover is often in territories in which many insurers would not normally be comfortable doing business, due to local reputation for corruption or instability, and so there are also reputational issues to consider.

Risk can also be mitigated via reinsurance. Unlike for many other lines of business, carriers might reinsure only the middle of their exposure, regarding cover lower down as too expensive and cover at higher levels as unnecessary.

In general, this is a capital-intensive business. The risks involved are uncertain and can be correlated. Insurers have to be aware of:

- Aggregated exposures (including those that are not direct aggregations but consequential to correlated economies). Insurers will have aggregate caps in place for business written just as they would for other classes.

- Cashflow uncertainties. Payments and salvage can be at very different times. The ultimate cost of claims for any particular underwriting year can be very uncertain and traditional methods of actuarial reserving are inappropriate for this business.

- Multi-year contracts (e.g., to cover a development project, where the earning pattern will not necessarily be level and where the cover provided can vary as the contract ages). This is often more like a loan, so it amortises over time.

On the other hand, many insurers actively seek some exposure to political risk covers. Political risk is largely uncorrelated with the main risk types found in insurers’ portfolios. Having some exposure in the portfolio can improve a (re)insurer’s diversification. However, this has resulted in political risk cover being widely available in the market at levels that more than meet even the increasing demand. This in turn has led to premium rating levels that appear to be lower than ever despite the perceived mounting levels of political risk in today’s world.

Wrap-up

Political risk insurance policies aim to protect businesses and business ventures in locations and against perils that other conventional insurance policies would not cover. With ongoing political and economic instability throughout the world, this type of insurance is becoming more popular as companies look to protect their interests.